What Is A Reverse Mortgage for Purchase?

A reverse mortgage for purchase, also known as a Home Equity Conversion Mortgage for Purchase (HECM for Purchase or H4P), allows seniors to purchase a home while also receiving cash from the equity in their home.

The HECM for purchase loan is different from a traditional mortgage in that it allows the senior to receive cash from their home’s equity rather than making payments to the lender. You can use this cash for various purposes, such as paying for home repairs, medical expenses, or other living expenses. The senior retains home ownership, but the lender holds a lien on the property until the repayment of the loan.

Repayment of the loan is when the senior pays off the reverse mortgage loan, dies, sells the home, or passes it to their heirs. This type of mortgage is an excellent option for retirees who want to buy a new home and not be burdened with a monthly mortgage payment.

How Does A Reverse Mortgage for Purchase Work?

A reverse mortgage for purchase loan allows borrowers to buy a home during the transaction. You can take out a HECM loan and purchase a new home all in one transaction through the reverse mortgage for purchase program.

You may wish to downsize from your current home, which requires extensive upkeep or maintenance. Or, a single-story home may be more attractive than your existing home and may be more equipped for aging. You may want to relocate to your house to be closer to family. Allowable property types, including single-family homes, 2- to 4-unit properties, HUD-approved condos, and planned unit developments.

What Can A Reverse Mortgage for Purchase Be Used For?

As the name suggests, a HECM Reverse mortgage can be used to purchase a new home and not have monthly mortgage payments. A reverse mortgage for purchase requires an initial down payment on a home or cash to cover closing costs and other expenses associated with buying and owning a house. From there on, you only have to pay the property taxes, homeowners insurance, and maintain the home. There are no monthly mortgage payments to make.

Who Is Eligible For A Reverse Mortgage for Purchase?

A reverse mortgage for purchase, also known as a Home Equity Conversion Mortgage for Purchase (HECM for Purchase), is designed for seniors who are 62 or older and are looking to purchase a new home. The senior must have the financial capacity to purchase the home and maintain the property. They also need to undergo an application and complete underwriting by the lender.

The senior must also complete a counseling session to ensure they understand the terms and conditions of the loan and the potential impact on their estate. In addition, the senior must also meet the property requirements set by the lender, such as the home’s condition and the property’s location.

Down Payment Requirements of a Reverse Mortgage for Purchase

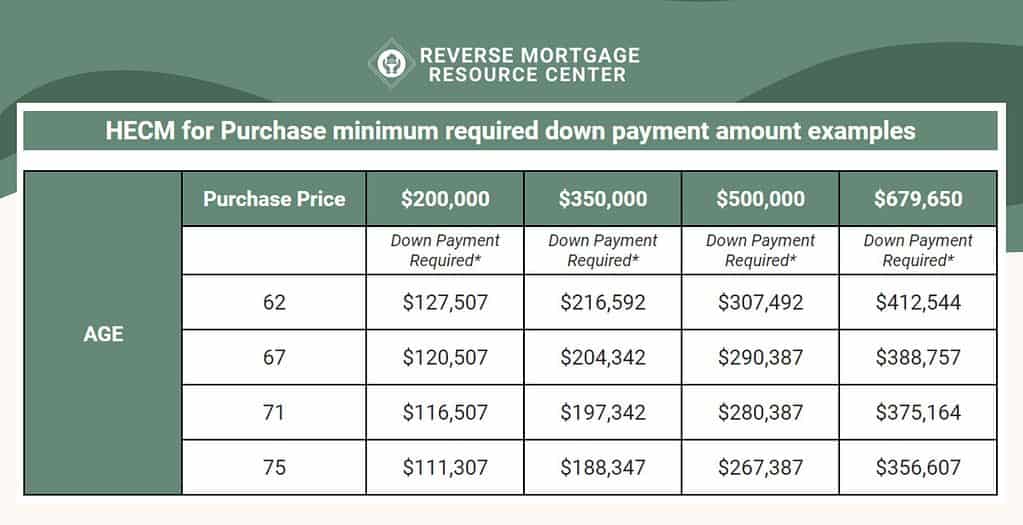

Depending on the buyer’s age or, if applicable, the age of the Eligible Non-Borrowing Spouse, the required minimum down payment is between about 45% and 62% of the purchase price. This range would be from the perspective that you will finance your closing costs.

The HECM loan provides the rest of the money for the purchase. Compared to paying all cash, this lets the buyers keep more assets to use as they wish while still giving them the freedom not to make monthly mortgage payments.

How Much Money Can You Get From A Reverse Mortgage for Purchase?

The actual amount of the down payment depends on the interest rate, the age of the borrower, and other things. This range is on the idea that you will add the closing costs to the loan.

Closing costs include an up-front mortgage premium and other lender and third-party costs like an origination fee, title insurance, appraisal fee, credit report fee, and recording costs, among others. Most closing costs can be financed into the loan, so your out of pocket expense could be minimal..

Types Of Reverse Mortgage for Purchase

There are two types of reverse mortgages for purchase: the HECM for Purchase and the Proprietary Reverse Mortgage Purchase.

The HECM for Purchase is the federally insured reverse mortgage program backed by the Federal Housing Administration (FHA). HECM for Purchase loans are also referred to as H4P loans. The Proprietary Reverse Mortgage for Purchase is a private loan not by the FHA but by the lender providing the funds.

Alternatives To A Reverse Mortgage for Purchase

There are some alternatives if you’re considering a reverse mortgage for purchase but don’t want to go through the process. You could look into getting a traditional mortgage with a low down payment or use other home equity financing options, such as a home equity loan or line of credit.

Reverse Mortgage for Purchase Pros And Cons

Pros

- No monthly payments are required

- Keep more assets to use as you wish

Cons

- Must be 62 years or older

- Credit and income check is required

- Loan must meet property requirements set by the lender

- Up-front mortgage premium

Reverse Mortgage for Purchase Requirements

- Must be 62 years old or older

- Must have the financial capacity to make the purchase and keep the home clean and well-managed

- Must complete a counseling session with a HUD-approved counselor

- Must meet credit and income requirements

- Must meet property requirements set by the lender

Is A Reverse Mortgage for Purchase A Good Option For You?

A reverse mortgage loan may be a good option if you are looking to buy a home and don’t want to pay cash for the property, or take out a traditional mortgage. It can also be a good option if you want to keep more of your assets liquid for you to use and not have to make monthly mortgage payments. However, it is essential to understand the requirements and potential risks of the loan program before signing up for one.

A Reverse Mortgage for Purchase May Be A Beneficial Choice If:

- You are 62 years or older

- You don’t want a traditional mortgage

- You want to keep more of your assets

- You don’t want to make monthly mortgage payments

- You can meet the credit and income requirements set by the lender

- You can meet the property requirements set by the lender

A Reverse Mortgage for Purchase May Not Be Suitable If:

- You plan to move in a few years: Reverse mortgages are long-term loans, so if you’re planning to move within the next five years, a reverse mortgage may not be the right choice.

- You can’t make the required down payment: To secure a reverse mortgage for purchase, you must make a significant down payment—typically around 50%. A reverse mortgage won’t be an option if you don’t have the financial means to do this.

- You don’t meet the credit score requirements: Since reverse mortgages are loan products, you must still meet specific credit score requirements to qualify. If there are items on your credit report that disqualify you, then you won’t be able to get approved for a reverse mortgage.

- You can’t afford the property taxes and insurance: Property taxes and insurance payments are required for all homeowners with a reverse mortgage.

How To Apply For A Reverse Mortgage for Purchase

If you decide to use a reverse mortgage, the first step is to contact an approved FHA lender. The lender will help you determine if you meet the qualifications for the loan and will provide you with the necessary paperwork.

Once you have all the required documents, your lender will review them and guide you through the application process. It includes completing a credit check and a property appraisal. Once the lender issues a decision on whether or not you qualify for the loan, if approved, you can now move forward with receiving the loan amount and begin taking advantage of the benefits of a reverse mortgage.